UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x☒

Filed by a Party other than the Registrant o☐

Check the appropriate box:

| Preliminary Proxy Statement | |

| Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| Definitive Proxy Statement | |

| Definitive Additional Materials | |

| Soliciting Material Under §240.14a-12 |

AFC GAMMA, INC.

(Name of Registrant as Specified In Its Charter)

Not applicable

(Name(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check | ||

| No fee required | ||

| Fee paid previously with preliminary materials. | ||

| ☐ | Fee computed on table | |

| NOTICE OF ANNUAL MEETING OF |

Thursday, September 30, 2021May 23, 2024

10:00 a.m. Eastern Time

| How to ATTEND: | ||

| Items of Business: | (1) Elect the two directors named in the accompanying Proxy Statement to serve until the Company’s

(2) Ratify the appointment of CohnReznick LLP as the Company’s independent registered public accounting firm for the year ending December 31,

(3) Transact such other business as may properly come before the meeting or any postponements or adjournments thereof. | |

| Who May Vote: |

Your vote is important to us. Whether or not you expectintend to attend the annualvirtual meeting, via live audio webcast, please submitvote using the Internet, by telephone or by mail, in each case, by following the instructions in our Proxy Statement. Shareholders who execute a proxy as soon as possible to instruct how your shares are to be voted atmay nevertheless attend the annual meeting. If you participate invirtual meeting and vote yourtheir shares atduring the annual meeting, your proxy will not be used.virtual meeting.

| By Order of the Board of Directors, | |

| Leonard M. Tannenbaum | |

| April 9, 2024 | Executive Chairman |

August 17, 2021Important Notice Regarding the Availability of Proxy Materials:

This Proxy Statement and our 2023 Annual Report are available on the Internet at www.proxyvote.com

These materials are also available on our website at https://investors.afcgamma.com.

The other information on our corporate website does not constitute part of this Proxy Statement.

| AFC GAMMA, INC. | 2024 PROXY STATEMENT | 1 |

| TABLE OF CONTENTS |

| 2 | 2024 PROXY STATEMENT | AFC GAMMA, INC. |

525 Okeechobee Blvd., Suite 17701650

West Palm Beach, FL, 33401

| PROXY |

2024 Annual Meeting of StockholdersShareholders

To Be Held September 30, 2021Thursday, May 23, 2024

OurAFC Gamma, Inc.’s Board of Directors is soliciting your proxy for the 20212024 Annual Meeting of StockholdersShareholders (the “Annual Meeting”) to be held virtually on Thursday, September 30, 2021,May 23, 2024, at 10:00 a.m. Eastern Time, and at any and all postponements or adjournments of the Annual Meeting, for the purposes set forth in the Notice of Annual Meeting of StockholdersShareholders accompanying this Proxy Statement. This Proxy Statement and our 2020 Annual Report for the year ended December 31, 20202023 (the “2020“2023 Annual Report”) are first being made available to stockholdersshareholders on or about August 17, 2021.April 9, 2024.

We will be hosting the Annual Meeting via live audio webcast on the Internet. Any stockholder can listen to and participate in the Annual Meeting live via the Internet at www.virtualshareholdermeeting.com/AFCG2021. Stockholders may vote and submit questions while connected to the Annual Meeting on the Internet.

Youwebcast. Shareholders will not be able to virtually attend the Annual Meeting in person.via the internet by accessing www.virtualshareholdermeeting.com/AFCG2024 and entering the control number on the proxy card, voting instruction form or Notice of Internet Availability of Proxy Materials they previously received, as applicable.

Unless the context otherwise requires, references in this Proxy Statement to “AFC Gamma,” “Company,” “we,” “our,” “us,” and similar terms refer to AFC Gamma, Inc., a Maryland corporation.

Explanatory Note

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”). As an emerging growth company, we provide This proxy summary highlights information contained elsewhere in this Proxy Statement and does not contain all information that you should review and consider. Please read the scaled disclosure permitted under the JOBS Act. In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequencyentire proxy statement with which such votes must be conducted.

Under the JOBS Act, we will remain an “emerging growth company” until the earliest of: (i) the last day of the fiscal year during which we had total annual gross revenues of at least $1.07 billion (as indexed for inflation); (ii) the last day of the fiscal year following the fifth anniversary of the closing of our initial public offering on March 23, 2021; (iii) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt; and (iv) the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).care before voting.

| MEETING INFORMATION |

2024 Annual Meeting of StockholdersShareholders

|  |  |

|  |  |

| TIME AND DATE | PLACE | RECORD DATE |

10:00 a.m. Eastern Time on Thursday, | The Annual Meeting will be hosted AFCG2024. via live audio webcast on the Internet at www.virtualshareholdermeeting.com/ | March 26, 2024 |

| AFC GAMMA, INC. | 2024 PROXY STATEMENT | 3 |

Voting

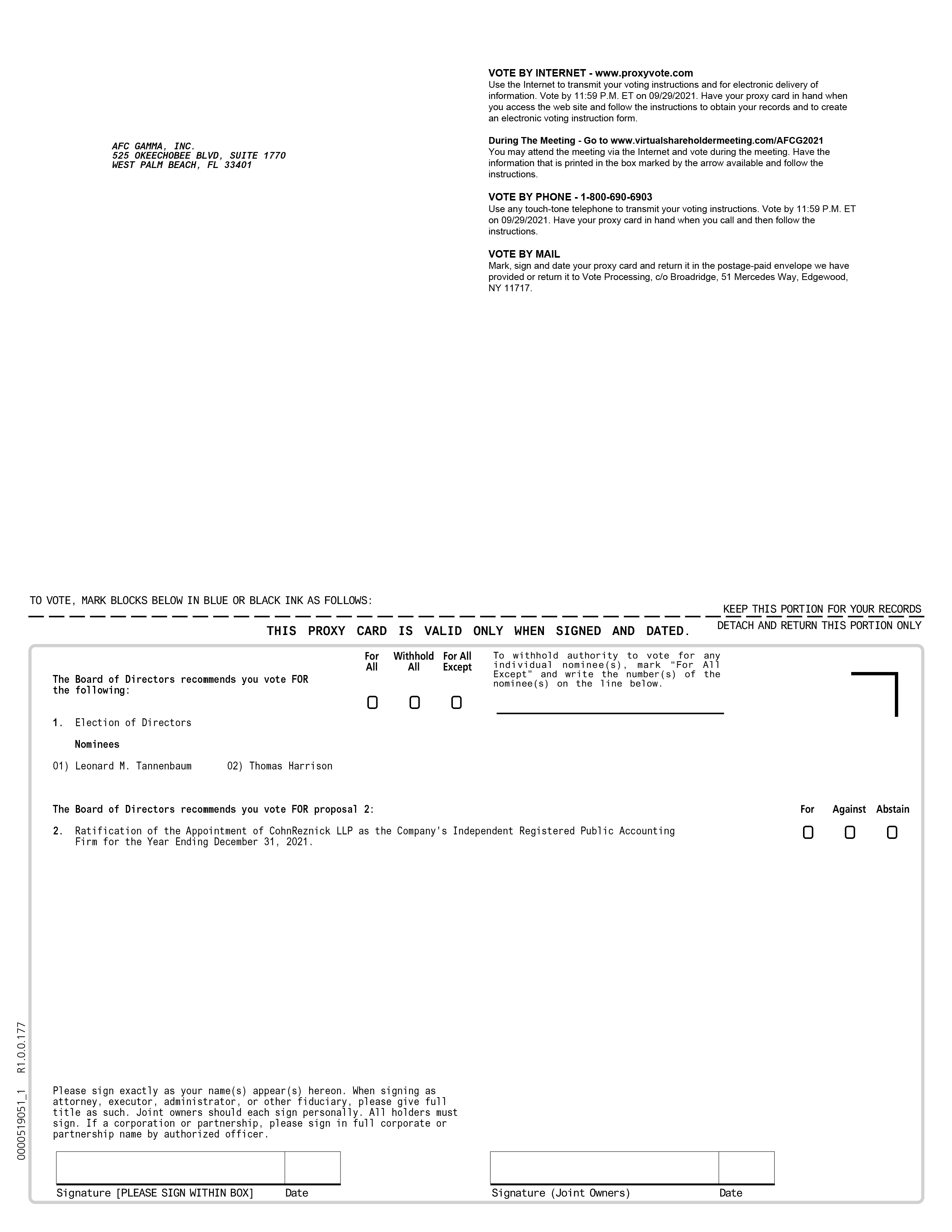

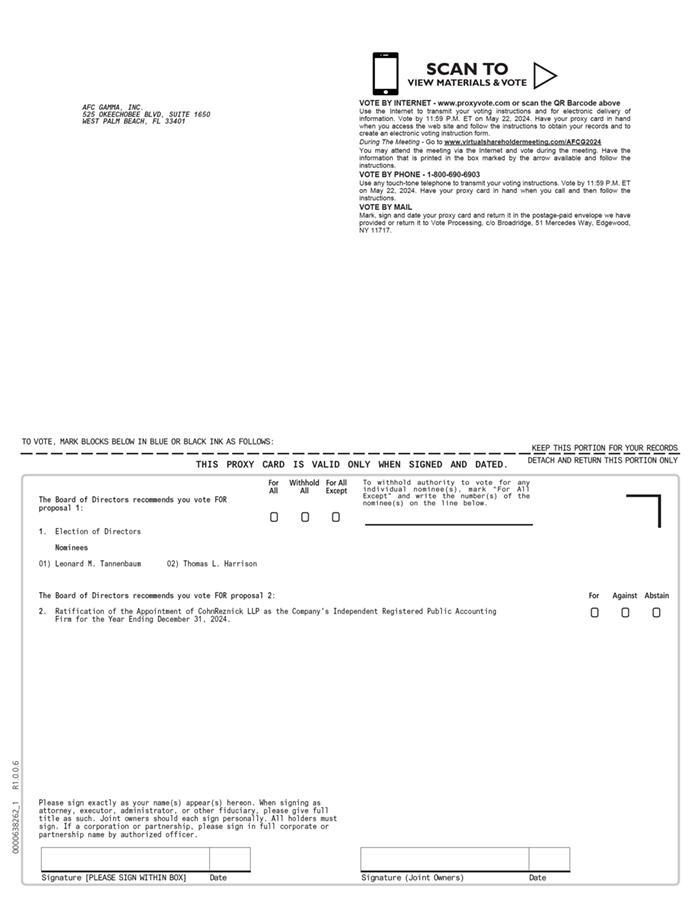

StockholdersShareholders as of the close of business on the record date are entitled to vote. If you are a beneficial owner who owns shares of our common stock, par value $0.01 per share (“Common Stock”), registered in the name of a broker, bank or other nominee, please follow the instructions they provide on how to vote your shares. StockholdersShareholders of record may vote as follows:

|   |   |

Vote by telephone by calling 1-800-690-6903. | Vote by Internet at | Complete and return each proxy card |

Vote during the meeting via the Internet at www.virtualshareholdermeeting.com/AFCG2021.AFCG2024.

Voting Matters

| PROPOSALS | BOARD RECOMMENDATION | |

| 1 | Election of Directors | FOR ALL director nominees |

| 2 | Ratification of the Appointment of CohnReznick LLP as the Company’s Independent Registered Public Accounting Firm for the Year Ending December 31, | FOR |

| PROPOSAL 1 |

|

Our Board of Directors (“Board” or “Board of Directors”) is currently comprised of seven directors. Under our Articles of Incorporation (the “Articles of Incorporation”), our Board of Directors is divided into three classes, each serving a staggered three-year term and with one class being elected at each year’s annual meeting of stockholdersshareholders as follows:

| ● | the Class I directors are Leonard Tannenbaum and Thomas Harrison, and their terms will expire at the Annual Meeting; |

| ● | the Class II directors are |

| ● | the Class III directors are James Fagan and Alexander Frank and |

Upon the recommendation of the Nominating and Corporate Governance Committee of our Board of Directors, our Board has nominated each of Leonard Tannenbaum and Thomas Harrison for election to our Board of Directors as Class I directors to serve until the 20242027 annual meeting of stockholdersshareholders and until their respective successors are duly elected and qualified. Proxies may only be voted for the two Class I directors nominated for election at the Annual Meeting.

Each of the director nominees has consented to being named in this Proxy Statement and to serving as a director, if elected. We have no reason to believe that any of the nominees will be unable or unwilling for good cause to serve if elected. However, if any nominee should become unable for any reason or unwilling for good cause to serve, the proxy holders will vote the proxies received by them for another person nominated as a substitute by the Board of Directors, or the Board of Directors may reduce the number of directors on the Board.

Biographical DescriptionsOur Directors

Set forth below is biographical information about each of our directorsdirector nominees and director nominees. The information below is provided as of August 6, 2021.our continuing directors. The primary experience, qualifications, attributes and skills of each of our director nominees that led to the conclusion of the Nominating and Corporate Governance Committee and the Board of Directors that such nominee should serve as a member of the Board of Directors are also described below.

Mr. Tannenbaum founded our Company in July 2020 and serves as our Chief Executive Officer. Mr. Harrison joined the Board in July 2020 and was initially identified as a potential director candidate by our Chief Executive Officer, Mr. Tannenbaum

| AFC GAMMA, INC. | |

PROPOSAL 1 —- ELECTION OF DIRECTORS

Nominees for Election as Class I Directors at the Annual Meeting

| Leonard M. Tannenbaum | |||

Class I Age: Director Since: 2020 | |||

Mr. Tannenbaum has served as our Executive Chairman and Chief Investment Officer since November 2023, prior to which he served as Chief Executive Officer and | |||

| KEY ATTRIBUTES | |||

| |||

| AFC Gamma. | |||

PROPOSAL 1 — ELECTION OF DIRECTORS

THOMAS L. HARRISON | ||

Class I Independent Age: Director Since: 2020 | POSITION AND BUSINESS EXPERIENCE | |

Since April 2019, Mr. Harrison has served as | ||

| KEY ATTRIBUTES | ||

| ||

All Other Continuing Directors

| ||

| ||

| ||

| AFC GAMMA, INC.| |

PROPOSAL 1 —- ELECTION OF DIRECTORS

All Other Continuing Directors | ||

| ||

| ||

| ||

| JODI HANSON BOND | ||

Class II Independent Age: Director Since: 2020 | POSITION AND BUSINESS EXPERIENCE | |

Since March 2020, Ms. Bond has served | ||

| KEY ATTRIBUTES | ||

Ms. Bond’s experience as a global business practitioner and her executive leadership positioning for corporate advancement and business strategy development across various countries bring meaningful insight to our Board. | ||

| ROBERT LEVY | ||

Class II Independent Age: 58 Director Since: 2020 | POSITION AND BUSINESS EXPERIENCE | |

Since January 2018, Mr. Levy has been a Managing Member at LBX Investments, a diversified commercial real estate investment firm. Prior to launching LBX Investments, Mr. Levy co-founded Big V Capital (“BVC”) in March of 2016, where he oversaw and underwrote the partnership’s 11 southeastern U.S. shopping center acquisitions and managed all debt and equity capital raising activities and asset management efforts. From May 2015 to June 2016, Mr. Levy was the Chief Operating Officer of the Real Estate Group at Benefit Street Partners, a multi-strategy credit manager with over $11.0 billion in assets under management. Prior to Benefit Street Partners, Mr. Levy held various leadership positions including Chief Executive Officer, Chief Operating Officer, Chief Financial Officer, and a member of the Board of Trustees at Centerline Capital Group, a multifamily finance and investment management company with over $13 billion in debt and equity under management. Mr. Levy received his M.B.A. from the Leonard M. Stern School of Business at New York University and his B.A. in Economics from Northwestern University. | ||

KEY ATTRIBUTES | ||

Mr. Levy brings extensive real estate industry knowledge and critical management experience in capital raising within the finance industry to our Board. | ||

| JAMES FAGAN | ||

Class III Independent Age: 65 Director Since: 2023 | POSITION AND BUSINESS EXPERIENCE | |

| Mr. Fagan began serving as a director in June 2023. Mr. Fagan has 40 years of commercial real estate experience having worked and held senior positions with both CBRE Group, Inc. and Cushman & Wakefield, Inc. His responsibilities have included supervising different offices for both CBRE & C&W in the New York metropolitan region, including Connecticut, Long Island, New Jersey and Manhattan. Mr. Fagan has acted as a broker on hundreds of millions dollars’ worth of transactions in both leasing and capital markets arenas. Mr. Fagan also has been a leader in implementing acquisitions and strategic initiatives undertaken by both CBRE and C&W. He is a graduate of the University of Connecticut. | ||

| KEY ATTRIBUTES | ||

| Mr. Fagan brings to our Board extensive commercial real estate industry knowledge and valuable experience with the finance industry. | ||

PROPOSAL 1 — ELECTION OF DIRECTORS

| AFC GAMMA, INC. | 2024 PROXY STATEMENT | 9 |

| ALEXANDER C. FRANK | ||

Class III Independent Age: Director Since: 2020 | POSITION AND BUSINESS EXPERIENCE | |

| ||

| KEY ATTRIBUTES | ||

Mr. Frank brings to our Board a deep knowledge of financial management. He provides our Board with key insights to the financial markets, capital raising activities, and the management of a large, complex business. | ||

Class III Independent Age: Director Since:

| POSITION AND BUSINESS EXPERIENCE | |

| ||

| KEY ATTRIBUTES | ||

| ||

| 10 | 2024 PROXY STATEMENT | AFC GAMMA, INC. |

| Corporate Governance |

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines to assist the Board in the exercise of its duties and responsibilities and to serve the best interests of the Company and our stockholders.shareholders. Our Corporate Governance Guidelines direct our Board’s actions with respect to, among other things, our Board composition, responsibilities of directors, director compensation, director orientation and continuing education, succession planning and the Board’s annual performance evaluation. A current copy of our Corporate Governance Guidelines is available under “Corporate Governance” on our website at https://investors.afcgamma.com/.investors.afcgamma.com.

Director Independence

Under the rules of the Nasdaq Stock Market (the “Nasdaq”(“Nasdaq”) and our Corporate Governance Guidelines, independent directors must comprise a majority of our Board of Directors. Under the Nasdaq rules, a director will only qualify as an “independent director” if our Board of Directors affirmatively determines that the director, in the opinion of our Board of Directors, does not have a relationship which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Our Board reviews any relationship that each of our directors has with us, either directly or indirectly, that could interfere with exercising independent judgment in carrying out a director’s responsibilities. Our Board has affirmatively determined that each of Mr. Thomas L.Messrs. Harrison, Mr. Alexander C. Frank, Mr. Tomer J. Tzur, Mr. RobertFagan and Levy, and Ms. Jodi HansonMses. Bond and Sudnow is “independent” as that term is defined under the rules of the Nasdaq. Mr. Tannenbaum is not an independent director as a result of his position as our Chief Executive Officer and Mr.Investment Officer. Jonathan Kalikow, iswho served on our Board until his resignation in September 2023, did not qualify as an independent director as a result of his position as our Head of Real Estate.Estate during the period of his service on our Board.

Board Leadership Structure

We do not have a fixed policy as to whether the chairperson of our Board should be an independent director and we believe that our flexibility to select our chairman and reorganize our leadership structure from time to time is in the best interests of our Companyus and our stockholders.shareholders. Presently, Mr. Tannenbaum, our Chief ExecutiveInvestment Officer, serves as the Executive Chairman of the Board. We believe that we are best served through our existing leadership structure with Mr. Tannenbaum serving as an executiveExecutive Chairman of our Board combined with Mr. Harrison serving as lead independent director. We believe that Mr. Tannenbaum’s extensive finance industry and leadership experience and critical understanding of our business and knowledge of how to craft and execute on our business and strategic plans qualifies him to serve as the Executive Chairman of the Board, and his relationship with AFC Management, LLC (our “Manager”) provides an effective bridge between our Board and our Manager, thus ensuring an open dialogue between our Board and our Manager and that both groups act with a common purpose.

We believe that the leadership structure of our Board must be evaluated on a case-by-case basis and that our existing Board leadership structure provides sufficient independent oversight over our Manager. In addition, we believe that the current governance structure, when combined with the functioning of the independent director component of our Board and our overall corporate governance structure, strikes an appropriate balance between strong and consistent leadership and independent oversight of our business and affairs. However, we re-examine our corporate governance policies on an ongoing basis to ensure that they continue to meet our needs.

| AFC GAMMA, INC. | 2024 PROXY STATEMENT | 11 |

The Board’s Role in Risk Oversight

One of the key functions of our Board is informed oversight of our risk management process. Our Board administers this oversight function directly, with support from its three standing committees, the Audit and Valuation Committee, the Compensation Committee and the Nominating and Corporate Governance

CORPORATE GOVERNANCE

Committee, each of which addresses risks specific to its respective areas of oversight as discussed below. In addition, our Manager has also established an Investment Committee for us, the members of which consist of employees of our Manager and/or its affiliates, and which currently includes certain affiliates of our Manager and certain of our officers. The Investment Committee works in conjunction with our Board to manage our credit risk through a comprehensive investment review process.

| Audit and Valuation Committee. Our Audit and Valuation Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit and Valuation Committee also monitors compliance with legal and regulatory requirements and the review and approval of our related party transactions, in addition to oversight of the performance of our internal audit function (to the extent such function is required by applicable rules and regulations). Because the Audit and Valuation Committee is already charged with approving our related party transactions, our Board has charged the Audit and Valuation Committee with overseeing amounts payable to our Manager pursuant to our Management Agreement and making recommendations to our Board with respect to our Board’s approval of the renewal of our Management Agreement. |

| Compensation Committee. Our Compensation Committee is generally responsible for discharging the Board’s responsibilities relating to the compensation, if any, of our executive officers and directors, overseeing the expense reimbursement of our Manager and its affiliates for compensation paid by such entities to their respective employees pursuant to our management agreement, by and between us and our Manager (the “Management Agreement”), the administration and implementation of our incentive and equity-based compensation plans, including the 2020 Stock Incentive Plan, and the preparation of reports on or relating to executive compensation required by the rules and regulations of the Securities and Exchange Commission (the “SEC”). |

| Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee provides oversight with respect to corporate governance and ethical conduct and monitors the effectiveness of our corporate governance guidelines, including whether such guidelines are successful in preventing illegal or improper liability-creating conduct. |

In addition, our Board and the Audit and Valuation Committee meet regularly with our Manager and consider the feedback our Manager provides concerning the risks related to our enterprise, business, operations and strategies. Our Manager regularly reports to our Board and the Audit and Valuation Committee on our loan portfolio and the risks related thereto, asset impairments, leverage position, affiliate payments (including payments made and expenses reimbursed pursuant to the terms of the Management Agreement), compliance with applicable covenants under the agreements governing our indebtedness, compliance with our qualification as a real estate investment trust (“REIT”) and compliance with our exemption from registration as investment company under the Investment Company Act of 1940, as amended. Members of our Board are routinely in contact with our Manager and our executive officers, as appropriate, in connection with their consideration of matters submitted for the approval of our Board or the Audit and Valuation Committee and the risks associated with such matters.

We believe that the extent of our Board’s (and its committees’) role in risk oversight complements the Board’s leadership structure because it allows our independent directors, through the twothree fully independent Board committees, executive sessions with the independent auditors, and otherwise, to exercise oversight of risk without any conflict that might discourage critical review.

| 12 | 2024 PROXY STATEMENT | AFC GAMMA, INC. |

We believe that a board of directors’ role in risk oversight must be evaluated on a case by case basis and that our Board’s role in risk oversight is appropriate. However, we re-examine the manner in which our Board administers its oversight function on an ongoing basis to ensure that it continues to meet our needs.

Committees of the Board of Directors

The Board has three standing committees: the Audit and Valuation Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Each of our standing committees is comprised solely of independent directors. The written charters of these committees are

CORPORATE GOVERNANCE

available under “Corporate Governance” on our website at https://investors.afcgamma.com/.investors.afcgamma.com.

| Audit & Valuation | Compensation | Nominating & Corporate Governance | |

| Jodi Hanson Bond |   |   | |

Alexander Frank   |

|

| |

| Thomas Harrison |   |

|  |

Robert Levy   |   |  | |

| Marnie Sudnow |  |

| Committee Member |   | Financial Expert |

Committee Member

Financial Expert

Audit and Valuation Committee

Our Audit and Valuation Committee consists of three members, Mr.Messrs. Frank, Harrison Mr. Frank and Mr. Levy, with Mr. Frank serving as chairperson.Chair of the committee. Our Board has affirmatively determined that each of Mr. Harrison, Mr. Frank and Mr. Levy is independent under Nasdaq rules and also meets the enhanced standards of “independence” established by Nasdaq and the SEC for members of the Audit and Valuation Committee. Our Board has also determined that (i) Mr. Frank and Mr. Levy each qualify as an “audit committee financial expert” under SEC rules and regulations and (ii) each member of the Audit and Valuation Committee is “financially literate” as the term is defined by Nasdaq listing standards.

| AFC GAMMA, INC. | 2024 PROXY STATEMENT | 13 |

The Audit and Valuation Committee’s principal functions include oversight related to:

| the integrity of our financial statements; |

| the qualifications and independence of any independent registered public accounting firm engaged by us; |

| the performance of our internal audit function (to the extent such function is required by applicable rules and regulations) and any independent registered public accounting firm; |

| the determination of the fair value of assets that are not publicly traded or for which current market values are not readily available; and |

| the entry and monitoring of related party transactions. |

The Audit and Valuation Committee assists our Board in its management of our Company.AFC Gamma. In particular, the Audit and Valuation Committee (i) serves as an independent party to monitor our financial reporting processes and internal control system; (ii) discusses the audit conducted by our independent registered public accounting firm; (iii) provides an open avenue of communication among our independent registered public accounting firm, our management and our Board; and (iv) serves as an independent party to review, approve and monitor our related party transactions.

The responsibilities of the Audit and Valuation Committee include, but are not limited to, (i) the appointment,

CORPORATE GOVERNANCE

compensation, retention and oversight of any independent registered public accounting firm engaged by us, discussus; (ii) discussing and reviewreviewing guidelines and policies with respect to risk assessment and risk management, reviewmanagement; (iii) reviewing the adequacy of our internal audit function (to the extent such function is required by applicable rules and regulations), assist; (iv) assisting in performing oversight responsibilities for the internal control systems and disclosure procedures, recommendprocedures; (v) recommending to our Board whether the financial statements should be included in reports made available to its stockholdersshareholders; and meet(vi) meeting periodically with management to discuss any of the above or any identified issues.

Subject to the provisions of our related person transaction policies and procedures, the Audit and Valuation Committee is also responsible for reviewing and approving our related party transactions, including matters related to our Management Agreement. Because the Audit and Valuation Committee is already charged with approving our related party transactions, our Board has charged the Audit and Valuation Committee with overseeing amounts payable to our Manager pursuant to our Management Agreement and making recommendations to our Board with respect to our Board’s approval of the renewal of our Management Agreement. The Audit and Valuation Committee and our Board must approve any renewal of our Management Agreement. See “Transactions With Related Persons — Policies and Procedures Regarding Related Party Transaction” for additional information.

Compensation Committee

Our Compensation Committee consists of three members, Mr.Messrs. Levy and Harrison and Ms. Bond, and Mr. Harrison, with Mr. Harrison serving as chairperson.Chair of the committee. Our Board has affirmatively determined that each of Mr.Messrs. Levy and Harrison and Ms. Bond and Mr. Harrison is independent under Nasdaq rules and also meets the enhanced standards of independence established by Nasdaq and the SEC for members of the Compensation Committee. In making this determination, the Board considered whether the director has a relationship with the Company that is material to the director’s ability to be independent from management in connection with the duties of a member of the Compensation Committee.

The Compensation Committee’s principal functions include:

| discharging the Board’s responsibilities relating to the compensation, if any, of our executive officers and directors; |

| 14 |

| ● | overseeing the expense reimbursement of our Manager and its affiliates for compensation paid by such entities to their respective employees pursuant to our Management Agreement; |

| administering and implementing our incentive and equity-based compensation plans, including the 2020 Stock Incentive Plan; and |

| preparing reports on or relating to executive compensation required by the rules and regulations of the SEC. |

The Compensation Committee has the sole authority to retain and terminate compensation consultants to assist in the evaluation of compensation matters and the sole authority to approve the fees and other retention terms of such compensation consultants. The Compensation Committee, with input from its compensation consultant, if any, and our Manager, discusses and considers potential risks that arise from our compensation practices, policies and programs. In November 2022, the Compensation Committee retained Exequity LLP (“Exequity”) as an independent compensation consultant to advise on executive compensation for the 2023 fiscal year. Exequity does not provide any other services to our Board or our Company. Our Compensation Committee has assessed the independence of Exequity pursuant to Nasdaq listing standards and determined that it is independent, and free of conflicts of interest with us or any of our directors or executive officers.

In addition, the Compensation Committee may form and delegate authority to sub-committees or, to the extent permitted under applicable laws, regulations and Nasdaq rules, to any other independent director or committee comprised entirely of independent directors, in each case, to the extent the Compensation Committee deems necessary or appropriate.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee currently consists of three members, Ms.Mr. Frank and Mses. Bond Mr. Harrison and Mr. Frank,Sudnow, with Mr. Frank serving as chairperson.Chair of the committee. Our Board has affirmatively determined that that each of Ms.Mr. Frank and Mses. Bond Mr. Harrison and Mr. FrankSudnow is independent under Nasdaq rules.

| AFC GAMMA, INC. | |

CORPORATE GOVERNANCE

The Nominating and Corporate Governance Committee charter defines the Nominating and Corporate Governance Committee’s principal functions, including:

| identifying individuals to become members of the Board, consistent with the procedures and selection criteria established by the Nominating and Corporate Governance Committee; | ||

| periodically reviewing the size and composition of the Board and recommending to the Board such modifications to its size and/or composition as are determined by the Nominating and Corporate Governance Committee to be necessary or desirable; | ||

| recommending to the Board the director nominees for the next annual meeting of | ||

| recommending to the Board individuals to fill vacant Board positions; | ||

| recommending to the Board committee appointments and chairpersons; | ||

| developing and recommending to the Board a set of corporate governance principles, a Code of Business Conduct and Ethics and related corporation policies, practices and procedures; | ||

| periodically reviewing and recommending to the Board updates to our corporate governance principles, Code of Business Conduct and Ethics and related corporation policies, practices and procedures; | ||

| monitoring the Company’s compliance with applicable corporate governance requirements; and | ||

| overseeing an annual evaluation of the Board, its committees and individual directors. | ||

Meetings and Attendance

During 2023, the fiscal 2020 year, our Board of Directors held eleven (11)12 meetings, the Audit and Valuation Committee held three (3)10 meetings, the Compensation Committee held one (1) meeting2 meetings and the Nominating and Corporate Governance Committee held one (1) meeting.2 meetings. Each of our directors attended at least 75% of the aggregate meetings of the Board and the committees of the Board on which he or she served during the fiscal 2020 year.2023. In addition, independent directors of our Board of Directors meet in regularly scheduled sessions without management.

It is the Board’s policy that all directors are invited and encouraged to attend the Company’s annual meeting of stockholders,shareholders, either in person or telephonically. We did not hold a 2020Two of our directors, Messrs. Frank and Harrison, attended our 2023 annual meeting of stockholders because we first became a publicly traded company in 2021.shareholders.

Succession Planning

The Board works on a periodic basis with the executive officers of the Manager to develop, review, maintain and revise, if necessary, the Company’s succession plan upon the Chief Executive Officer’s retirement, the termination or non-renewal of the Manager under the Management Agreement or in the event of an unexpected occurrence. The Chief Executive Officer’s recommendations regarding his or her successor should he or she be unexpectedly disabled are made available to the Board on a continuing basis.

Annual Self-Evaluation Process

At least annually, the Nominating and Corporate Governance Committee will overseeoversees and coordinatecoordinates a self-assessment of the Board and each committee’s own performance, as well as consideringperformance. These self-assessments also take into account other corporate governance principles that may, from time to time, merit consideration by the Board and each committee respectively. We expect to conduct our firstcommittee. The Board conducted its annual self-assessment process in 2021.December 2023.

CORPORATE GOVERNANCE

The assessment of the Board will generally include a review of any areas in which the Board or management believes the Board can make a better contribution to the governance of the Company, as well as a review of the committee structure and an assessment of the Board’s compliance with the principles set forth in the our Corporate Governance Guidelines. The purpose of the review will beis to improve the performance of the Board as a unit, and not to target the performance of any individual Board member. The Board will utilizeutilizes the results of this evaluation process in assessing and determining the characteristics and critical skills required of prospective candidates for election to the Board. Each committee of the Board will conductconducts its self-assessment under the oversight of the Nominating and Corporate Governance Committee in accordance with the provisions set forth in its respective charter.

Consideration of Director Candidates

Our Board of Directors and the Nominating and Corporate Governance Committee will consider director candidates recommended for election to the Board of Directors by stockholdersshareholders in the same manner and using the same criteria as that used for any other director candidate. All recommendations must be directed to the Nominating and Corporate Governance Committee c/o Corporate Secretary at 525 Okeechobee Blvd., Suite 1770,1650, West Palm Beach, FL, 33401. Recommendations for director nominees to be considered at the 20222025 annual meeting of stockholdersshareholders must be received in writing not later than April 19, 2022,December 10, 2024, which is 120 days prior to the one-year anniversary of the date this Proxy Statement is first available to stockholders.shareholders.

InOur Board of Directors does not have a formal diversity policy. However, in evaluating a director candidate, the Nominating and Corporate Governance Committee will consider the following criteria, among others the Nominating and Corporate Governance Committee shall deem appropriate: (i) business and professional background, (ii) contribution to the Board’s diversity of experience, profession, expertise, skill and background (including with respect to race and gender); (iii) history of leadership or contributions to other organizations; (iv) functional skill set and expertise; (v) general understanding of marketing, finance, accounting, corporate governance, federal securities and other relevant laws and regulations, and other elements relevant to the success of a publicly-traded company in today’s business environment; (vi) meets high ethical standards; (vii) experience in the cannabis or REIT industries and/or as a member of the board of directors of another publicly-held company; (viii) commitment to devoting the time and effort necessary to be a responsible and productive member of the Board of Directors; and (ix) ability to perpetuate the success of the business and represent stakeholder interests.

StockholdersShareholders who wish to nominate a person for election as a director in connection with an annual meeting of stockholdersshareholders (as opposed to making a recommendation to the Nominating and Corporate Governance Committee as described above) must deliver written notice to our Secretary in the manner described in our Amended and Restated Bylaws (“Bylaws”), and as described further under “Proposals of Stockholders“Shareholder Proposals and Director Nominations for 20222025 Annual Meeting” below.

Outside Directorships

In recent years, some investors and proxy advisors have instituted “bright-line” proxy voting policies on the number of outside public company boards that a director may serve on. Our Board recognizes investors’ concerns that highly sought-after directors could lack the time and attention to adequately perform their duties and responsibilities, and considers each director’s performance and commitment to ensure their continued effectiveness as a director. Our corporate governance guidelines contemplate that no director may simultaneously serve on the boards of directors of more than four other public companies, excluding our portfolio companies, unless our Board of Directors determines that such simultaneous service would not impair the ability of such director to effectively serve the Company.

| AFC GAMMA, INC. | 2024 PROXY STATEMENT | 17 |

Communications with the Board of Directors

StockholdersShareholders or other interested parties who wish to contact the Board, the lead independent director, any Board committee, or our independent directors as a group may send written correspondence c/o Board of Directors at 525 Okeechobee Blvd., Suite 1770,1650 West Palm Beach, FL, 33401. The name of any specific intended Board recipients should be clearly noted in the communication. All communications will be received, processed and then forwarded to the appropriate member(s) of our Board, except that, certain items unrelated to the Board’s duties and responsibilities, such as spam, junk mail, mass mailings, solicitations, resumes and employment inquiries and similar items will not be forwarded. Board members receiving communications will respond as such directors deem appropriate, including the possibility of referring the matter to our management of our Company,team, to the full Board or to an appropriate committee of the Board. In addition, if requested by stockholders,shareholders, our lead independent director will ensure that he is available, when appropriate, for consultation and direct communication with stockholders.shareholders.

Policy on Pledging and Hedging of Company Shares

Our insider trading policy provides that insiders, which includes all directors, officers and employees of the Company, are prohibited from purchasing financial instruments (including prepaid variable forward contracts,

CORPORATE GOVERNANCE

equity swaps, collars and exchange funds), or otherwise engaging in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of the Company’s securities. In addition, our insider trading policy provides that insiders are prohibited from margining the Company securities in a margin account or pledging Company securities as collateral for a loan.

Code of Business Conduct and Ethics

We have adopted a written code of business ethics that seeks to identify and mitigate conflicts of interest between us and our employees, if any, directors and officers. A current copy of the code is posted under “Corporate Governance” on our website at https://investors.afcgamma.com/.investors.afcgamma.com. To the extent required by rules adopted by the SEC and Nasdaq, we intend to promptly disclose future amendments to certain provisions of the code, or waivers of such provisions granted to executive officers and directors, on our website at https://investors.afcgamma.com/.investors.afcgamma.com.

| Executive Officers of the Company |

The table below sets forth certain information regarding our executive officers as of August 11, 2021:officers:

| Name | Age | Position |

| Leonard M. Tannenbaum(1) | Executive Chairman and Chief Investment Officer | |

| Daniel Neville(2) | 38 | Chief Executive Officer |

| Chief Financial Officer and Treasurer | ||

| Robyn Tannenbaum(4) |

| (1) | On October 26, 2023, Mr. Tannenbaum resigned as Chief Executive Officer of the Company, effective November 13, 2023. On October 26, 2023, the Company appointed Mr. Tannenbaum to serve as its as Executive Chairman and Chief Investment Officer. |

| (2) | On November 13, 2023, the Company appointed Mr. Neville to serve as its Chief Executive Officer. |

| (3) | On March 17, 2023, the Company appointed Mr. Hetzel to serve as its Chief Financial Officer and Treasurer. |

| (4) | On March 7, 2023, the Company appointed Mrs. Tannenbaum to serve as its President. |

See “Proposal 1 — Election of Directors” for information concerning the business experience of Mr. Tannenbaum and Mr. Kalikow.Tannenbaum. Information concerning the business experience of our other executive officers is set forth below.

| AFC GAMMA, INC. | 2024 PROXY STATEMENT | 19 |

Daniel Neville | Mr. |

| Brandon Hetzel | Mr. Hetzel has served as our Chief Financial Officer and Treasurer since |

| Robyn Tannenbaum | Mrs. Tannenbaum has served as our President since March 2023, prior to which she served as our Managing Director, Head of Origination and Investor Relations since July 2020. Mrs. Tannenbaum has served as the President of SUNS since February 2024. Mrs. Tannenbaum has over 7 years’ experience focusing on mergers and acquisitions and leveraged loans to healthcare companies. Additionally, she has |

Other than between Mr. Leonard Tannenbaum and Mrs. Robyn Tannenbaum, who are husband and wife, there are no family relationships between or among any of our executive officers or directors.

| 20 | 2024 PROXY STATEMENT | AFC GAMMA, INC. |

| Executive COMPENSATION |

We do not have any employees nor do we intend to hire any employees who will be compensated directly by us. Our loans are sourced and overseen by the members of our senior team, which currently consists of over 20 investment and other professionals who are employees of our Manager and/or its affiliates.team. Each of our executive officers, including each executive officer who serves as a director, is employed by our Manager and/or its affiliates and receives compensation for his or her services, including services performed on our behalf, from our Manager and/or its affiliates, as applicable, except we may award equity-based incentive awards for our executive officers under our 2020 Stock Incentive Plan. Instead, we pay our Manager the fees described under “Management Compensation” in our 2023 Annual Report on Form 10-K and we indirectly bear the costs of the compensation paid to certain of our executive officers through expense reimbursements we pay to our Manager or its affiliates, as applicable. Pursuant to our Management Agreement, we reimburse our Manager or its affiliates, as applicable, for our fair and equitable allocable share of the compensation, including annual base salary, bonus, any related withholding taxes and employee benefits, paid to (i) subject to review by the Compensation Committee of our Board, our Manager’s personnel serving as our Chief Executive Officer (except when the Chief Executive Officer serves as a member of the Investment Committee prior to the consummation of an internalization transaction of our Manager by us), General Counsel, Chief Compliance Officer, Chief Financial Officer, Chief Marketing Officer, Managing Director and any of our other officers, based on the percentage of his or her time spent devoted to our affairs and (ii) other corporate finance, tax, accounting, internal audit, legal, risk management, operations, compliance and other non-investment personnel of the Manager and its affiliates who spend all or a portion of their time managing our affairs, with the allocable share of the compensation of such personnel described in this clause (ii) being as reasonably determined by our Manager to appropriately reflect the amount of time spent devoted by such personnel to our affairs. The service by any personnel of our Manager and its affiliates as a member of the Investment Committee will not, by itself, be dispositive in the determination as to whether such personnel is deemed “investment personnel” of our Manager and its affiliates for purposes of expense reimbursement. Prior to our IPO,initial public offering, we were not obligated to reimburse our Manager or its affiliates, as applicable, for any compensation paid to Mr. Tannenbaum, Mr. Kalikow, a former director and officer of the Company, or Mrs. Tannenbaum. For the 20212023 and 2022 fiscal year, we anticipate that our Manager willdid not seek reimbursement for our allocable share of Mr. Kalikow’sKalikow and Mr. Tannenbaum’s compensation, but willdid seek reimbursement for our allocable share of Mrs. Tannenbaum’s compensation. Mrs. Tannenbaum did not receive any increase in base salary, bonuses or awards from our Manager or its affiliates in connection with her appointment as President of the Company. We do not currently, nor do we intend to, pay any compensation directly to our officers, except we may award equity-based incentive awards for our officers under our 2020 Stock Incentive Plan. Our executive officers are entitled to receive awards in the future under our 2020 Stock Incentive Plan.

On March 17, 2023, the Company appointed Mr. Hetzel to serve as its Chief Financial Officer and Treasurer in place of Brett Kaufman, effective as of such date, with Mr. Kaufman’s employment with the Manager terminated, effective as of April 17, 2023 (the “Separation Date”). In connection with his termination, Mr. Kaufman received (i) twelve (12) months’ worth of his current base salary, (ii) his annual target bonus, (iii) continued payment by our Manager of 100% of the COBRA premiums for him and his dependents for a period of twelve (12) months following his Separation Date, (iv) accelerated vesting of one (1) additional tranche of each of Mr. Kaufman’s outstanding equity awards, and (v) extension of the exercise period for Mr. Kaufman’s outstanding options until one (1) year following the Separation Date, contingent on Mr. Kaufman executing and not revoking a release of claims in favor of the Company.

Mr. Hetzel entered into an employment agreement with our Manager, dated as of January 3, 2023, which provides that, in the event of a termination of Mr. Hetzel’s employment by the Manager other than for “cause” (which includes a non-renewal of the employment agreement term by the Manager), or his resignation for “good reason”, he will be entitled to twelve (12) months’ worth of his then-current base salary.

| AFC GAMMA, INC. | 2024 PROXY STATEMENT | 21 |

In connection with his appointment as Chief Executive Officer of the Company, Mr. Neville entered into an employment agreement with our Manager, dated as of October 30, 2023, which provides that, in the event of a termination of Mr. Neville’s employment by the Manager without “cause” (other than due to Mr. Neville’s death or “disability”), or his resignation for “good reason” (which includes a non-renewal of the employment agreement term by the Manager), Mr. Neville will be entitled to: (i) three months of base salary continuation; (ii) subject to Mr. Neville’s timely election of continuation coverage under COBRA, payment of 100% of medical, dental and vision premiums for Mr. Neville and his dependents for three months following the month in which the termination occurs; and (iii) the Company’s repurchase right with respect to Mr. Neville’s ownership of the Manager shall terminate and Mr. Neville’s restricted common stock award granted in connection with his commencement of employment shall fully vest.

The following table sets forth all compensation paid to or accrued by those named executive officers for whom we are able to quantify such compensation for services the named executive officer rendered to us during the fiscal period presented.

Summary Compensation Table

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |||||||||

| Thomas Geoffroy(1)(2) | 2020 | $86,430 | 20,740 | — | — | — | — | 9,690(3) | $116,860 | |||||||||

| (Chief Financial Officer) |

| Name and Principal Position | | Year | | Salary ($) | | Bonus ($) | | Stock Awards ($) | | Option Awards ($)(3) | | Non-Equity Incentive Plan Compensation ($) | | Nonqualified Deferred Compensation Earnings ($) | | All Other Compensation ($) | | Total ($) |

| Daniel Neville | 2023 | - | - | - | - | - | - | - | - | |||||||||

| (Chief Executive Officer) | ||||||||||||||||||

Leonard M. Tannenbaum(1) | | 2023 | - | | - | | 799,987 | - | - | | - | | - | 799,987 | ||||

| (Chief Investment Officer) | | 2022 | | - | | - | | - | | 731,300 | | - | | - | | - | | 731,300 |

| Brandon Hetzel | 2023 | 196,737 | 79,975 | 99,991 | - | - | - | - | 376,703 | |||||||||

| (Chief Financial Officer, effective March 2023) | ||||||||||||||||||

| Brett Kaufman(2) | | 2023 | 151,309 | - | 49,995 | - | - | | - | | 750,000 | 951,304 | ||||||

| (Former Chief Financial Officer) | | 2022 | | 474,611 | | 232,355 | | - | | 7,313 | | - | | - | | - | | 714,279 |

| Robyn Tannenbaum | | 2023 | 132,260 | - | 399,993 | - | - | | - | | - | 532,253 | ||||||

| (President) | | 2022 | | 123,126 | | - | | - | | 73,130 | | - | | - | | - | | 196,256 |

(1) Mr. Tannenbaum does not take a salary from the Company.

(2) On March 17, 2023, Brett Kaufman, the Company’s former Chief Financial Officer and Treasurer, employment with the Company was terminated, effective April 17, 2023.

(3) The option award amounts reflected in the table and the grant-date values are computed in accordance with FASB ASC Topic 718 for the stock and option awards granted to the Named Executive Officers in the corresponding fiscal year based on the assumptions set forth in Note 11 to the consolidated financial statements included in the Company’s Annual Report on Form 10-K filed with the SEC on March 7, 2024.

Outstanding Equity Awards at 2023 Fiscal Year-End

The following table presents information regarding the outstanding equity awards held by each of our named executive officers as of December 31, 2023, including the vesting dates for the portions of these awards that had not vested as of that date.

| | Option Awards | | Stock Awards | ||||||||||||||||

| | | | | | | | | Equity Incentive Plan Awards | | ||||||||||

| Name | | Number of securities underlying unexercised options exercisable | | Number of securities underlying unexercised options unexercisable | | Equity Incentive plan awards: Number of securities underlying unexercised unearned options | | Option exercise price ($) | | Option Expiration date(1) | | Number of shares that have not vested | | Market value of shares that have not vested ($) | | Number of unearned shares or other rights that have not vested | | Market value of unearned shares or other rights that have not vested ($) | |

Daniel Neville

| - | - | - | - | - | - | - | - | - | ||||||||||

| Leonard M. Tannenbaum | | - | | - | | - | | - | | - | | 51,380(2) | | 799,987 | | - | | - | |

| 670,978(3) | - | - | 14.71 | 8/12/2027 | - | - | - | - | |||||||||||

| | 105,980(3) | | - | | - | | 15.29 | | 11/18/2027 | | - | | - | | - | | - | | |

| | 630,000(3)(4) | | - | | - | | 19.00 | | 3/19/2028 | | - | | - | | - | | - | | |

| 500,000(3) | - | - | 20.18 | 1/11/2029 | - | - | - | - | |||||||||||

| Brett Kaufman | | - | | - | | - | | - | | - | | - | | - | | - | | - | |

| Robyn Tannenbaum | | - | | - | | - | | - | | - | | 25,690(2) | | 399,993 | | - | | - | |

| 20,160(5) | - | - | 14.71 | 8/12/2027 | - | - | - | - | |||||||||||

| | 14,000(4) | (5) | - | | - | | 19.00 | | 3/19/2028 | | - | | - | | - | | - | | |

| 50,000(5) | - | - | 20.18 | 1/11/2029 | - | - | - | - | |||||||||||

| Brandon Hetzel | - | - | - | - | - | 6,422(2) | 99,991 | - | - | ||||||||||

| - | - | - | - | - | 1,238(6) | 24,983 | - | - | |||||||||||

| 2,333(7) | 1,167(7) | - | 15.29 | 11/18/2027 | - | - | - | - | |||||||||||

| 2,333(7) | (4) | 4,667(7) | (4) | - | 19.00 | 3/19/2028 | - | - | - | - | |||||||||

(1) Options granted pursuant to awards under our 2020 Stock Incentive Plan expire seven years following the grant date.

(2) Represents restricted stock granted under the Issuer's Stock Incentive Plan and shall vest over a three-year period with approximately 33% vesting on each of the first, second and third anniversaries of January 3, 2023, subject to early termination and adjustment as provided in the applicable restricted stock grant agreement.

(3) Mr. Tannenbaum was granted four separate awards of options exercisable into shares of Common Stock on August 12, 2020, November 18, 2020, March 19, 2021 and January 11, 2022, respectively, which were fully vested on each respective grant date and became exercisable following the initial public offering.

(4) Grant award of options in connection with the consummation of our initial public offering on March 19, 2021.

(5) Mrs. Tannenbaum was granted three separate awards of options exercisable into shares of Common Stock on August 12, 2020, March 19, 2021 and January 11, 2022, respectively, which were fully vested on each respective grant date and became exercisable following the initial public offering.

(6) Represents restricted stock granted under the Issuer's Stock Incentive Plan and shall vest over a four-year period with approximately 33% vesting on each of the second, third and fourth anniversaries of January 11, 2022, subject to early termination and adjustment as provided in the applicable restricted stock grant agreement.

(7) Mr. Hetzel was granted two separate awards of options exercisable into shares of Common Stock on November 18, 2020 and March 19, 2021, respectively, which each vest over a four-year period with approximately 33% vesting on each of the second, third and fourth anniversaries of the respective grant date.

| AFC GAMMA, INC. | |

Equity Compensation Plan Information

The following table provides information about our Common Stock that may be issued as of December 31, 2023, under the 2020 Stock Incentive Plan, which is our only existing equity compensation plan.

| Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants, and Rights | Weighted- Average Exercise Price of Outstanding Options, Warrants, and Rights(1) | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding Securities Reflected in the First Column) (2) | |||

| Equity Compensation Plans Approved by Security Holders | 2,168,952 | $17.74 | 466,396 | ||

| Equity Compensation Plans Not Approved by Security Holders | - | - | - | ||

| Total at December 31, 2023 | 2,168,952 | $17.74 | 466,396 |

(1) Reflects the weighted-average exercise price of outstanding options granted under the 2020 Stock Incentive Plan.

(2) All of these shares remained available under our 2020 Stock Incentive Plan and may be used for any type of award authorized under our 2020 Stock Incentive Plan, including stock options, stock units, restricted stock and stock bonuses.

| 24 | 2024 PROXY STATEMENT | AFC GAMMA, INC. |

| COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION |

None of our executive officers serves, or in the past has served, as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who serve as members of our Board or our Compensation Committee. None of the members of our Compensation Committee is, or has ever been, our officer or employee.

| DIRECTOR COMPENSATION |

We pay each of our directors an annual cash retainer of $50,000 in cash in equal quarterly payments of $12,500.payments. Each director is entitled to reimbursement of reasonable expenses associated with attending board meetings. However, we do not pay our directors any fees for attending individual board or committee meetings. The lead independent director receives an additional $15,000 annual cash retainer in cash in equal quarterly payments of $3,750.payments. The Audit and Valuation Committee chairpersonChair receives an additional $25,000 annual cash retainer in cash in equal quarterly payments of $6,250.payments. The Compensation Committee chairpersonChair receives an additional $10,000 annual cash retainer in cash in equal quarterly payments of $2,500.payments. The Nominating and Corporate Governance Committee chairpersonChair receives an additional $5,000 annual cash retainer in cash in equal quarterly payments of $1,250.payments. Directors must attend at least 75% of all meetings of the Board and all committees on which the director sits (including separate meetings of non-management directors or independent directors) in any specified fiscal year in order to be eligible to receive director compensation. If a director is also one of our executive officers, we will not pay any compensation to such person for services rendered as a director. Additionally, our directors are entitled to receive awards in the future under our 2020 Stock Incentive Plan. At his request, we have deferred

The following table sets forth all compensation paid to or accrued by our directors for services rendered to us during the payment of Mr. Tzur’s director cash compensation in an aggregate amount equal to $22,500 and such payment is recorded in accounts payable on our balance sheets.fiscal period presented.

| Name | | | Year | | | Fees Earned Or Paid in Cash ($) | | | Stock Awards ($) | | | Option Awards ($)(1) | | | Total ($) |

| Thomas Harrison(2) | | | 2023 | | | 75,000 | | | 14,994 | | | - | | | 89,994 |

| Jodi H. Bond(3) | | | 2023 | | | 50,000 | | | 14,994 | | | - | | | 64,994 |

| James Fagan(4) | | | 2023 | | | 12,500 | | | 14,997 | | | - | | | 27,497 |

| Alexander Frank(5) | | | 2023 | | | 80,000 | | | 14,994 | | | - | | | 94,994 |

| Robert Levy(6) | 2023 | 50,000 | 14,994 | - | 64,994 | ||||||||||

| Marnie Sudnow(7) | | | 2023 | | | 50,000 | | | 14,994 | | | - | | | 64,994 |

(1) The option award amounts reflected in the table are computed in accordance with FASB ASC Topic 718 based on assumptions set forth in Note 11 to the consolidated financial statements included in the Company’s Annual Report on Form 10-K filed with the SEC on March 7, 2024.

(2) Fees earned includes additional annual retainer for service as the Lead Independent Director and Chair of the Compensation Committee. As of December 31, 2023, Mr. Harrison had vested options to purchase 6,400 shares of Common Stock and 963 unvested restricted stock awards scheduled to vest January 3, 2024.

(3) As of December 31, 2023, Ms. Bond had vested options to purchase 6,400 shares of Common Stock and 963 unvested restricted stock awards scheduled to vest January 3, 2024.

(4) Mr. Fagan was appointed to the Board in June 2023. As of December 31, 2023, Mr. Fagan had 1,159 unvested restricted stock awards scheduled to vest on June 20, 2024.

(5) Includes additional annual retainer for service as our Chair of the Audit and Valuation Committee and Nominating and Corporate Governance Committee. As of December 31, 2023, Mr. Frank had vested options to purchase 6,400 shares of Common Stock and 963 unvested restricted stock awards scheduled to vest January 3, 2024.

| AFC GAMMA, INC. | | 25 |

(6) As of December 31, 2023, Mr. Levy had vested options to purchase 6,400 shares of Common Stock and 963 unvested restricted stock awards scheduled to vest January 3, 2024.

(7) As of December 31, 2023, Ms. Sudnow had vested options to purchase 5,000 shares of Common Stock and 963 unvested restricted stock awards scheduled to vest January 3, 2024.

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

The following table sets forth certain information with respect to the beneficial ownership of our common stock,Common Stock, as of August 11, 2021,March 26, 2024, by:

| each person known by us to beneficially own more than 5% of the outstanding shares of our |

| each of our named executive officers and directors; |

| all of our current directors and executive officers as a group. |

The information below is based on 16,435,57020,667,094 shares of our common stockCommon Stock outstanding as of August 11, 2021.

Unless otherwise noted below, the address of each beneficial owner listed in the table below is 525 Okeechobee Blvd., Suite 1770, West Palm Beach, FL 33401.March 26, 2024.

We have determined beneficial ownership in accordance with the rulesRule 13d-3 of the SEC.Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the information is not necessarily indicative of beneficial ownership for any other purpose. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that each person or entity named in the table below has sole voting and investment power with respect to all shares of common stockCommon Stock that he, shesuch person or itentity beneficially owns, subject to applicable community property laws. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, we have deemed shares of our common stockCommon Stock subject to options that are currently vested and exercisable held by that person, or that will become exercisable and vest within 60 days of August 11, 2021March 26, 2024, to be outstanding, but we have not deemed these shares to be outstanding for computing the percentage ownership of any other person.

| Amount of Beneficial Ownership | % of Class | |||

| 5% Stockholders | ||||

| Leonard M. Tannenbaum (1) | 4,749,458 | 26.6% | ||

| UBS Group AG and UBS O’Connor LLC (2) | 981,136 | 6.0% | ||

| Named Executive Officers and Directors | ||||

| Leonard M. Tannenbaum (1) | 4,749,458 | 26.6% | ||

| Jonathan Kalikow (3) | 673,500 | 4.1% | ||

| Thomas L. Harrison (4) | 16,428 | * | ||

| Tomer J. Tzur (5) | 7,938 | * | ||

| Alexander C. Frank (6) | 8,085 | * | ||

| Jodi Hanson Bond (7) | 11,708 | * | ||

| Thomas Geoffory (8) | 3,269 | * | ||

| Robert Levy (9) | 700 | * | ||

| Robyn Tannenbaum (10) | 36,160 | * | ||

| All current executive officers and directors as a group (9 persons total)(11) | 5,553,020 | 31.1% |

| 26 | ||

| 2024 PROXY STATEMENT | AFC GAMMA, INC. |

| Name of Beneficial Owner (1) | Total Number of Shares Beneficially Owned | % of Common Stock | ||

| 5% Shareholders | ||||

| Leonard M. Tannenbaum (2) | 5,651,596 | 25.0% | ||

| BlackRock, Inc. (3) | 1,415,134 | 6.9% | ||

| Named Executive Officers and Directors | ||||

| Leonard M. Tannenbaum (2) | 5,651,596 | 25.0% | ||

| Daniel Neville (4) | - | — | ||

| Robyn Tannenbaum (5) | 150,038 | * | ||

| Brandon Hetzel (6) | 33,116 | * | ||

| Jodi Hanson Bond (7) | 19,653 | * | ||

| James Fagan (8) | 28,961 | * | ||

| Alexander C. Frank (9) | 15,330 | * | ||

| Thomas L. Harrison (10) | 23,673 | * | ||

| Robert Levy (11) | 8,645 | * | ||

| Marnie Sudnow (12) | 7,245 | * | ||

| All directors and executive officers as a group (10 persons) (13) | 5,938,257 | 26.2% |

*Less than 1% of the outstanding shares.

(1) Unless otherwise indicated, the address of each of the beneficial owners identified is 525 Okeechobee Blvd., Suite 1650, West Palm Beach, FL 33401.

(2) Includes (i) 3,744,638 shares of Common Stock and (ii) 1,906,958 shares of Common Stock which Mr. Tannenbaum has the right to acquire within 60 days of March 26, 2024 pursuant to outstanding and vested stock options.

(3) Beneficial and percentage ownership information is as of December 31, 2023 and is based on information reported on a Schedule 13G filed by Blackrock, Inc. with the SEC on January 26, 2024. The schedule indicates that Blackrock, Inc. has sole voting power over 1,415,134 shares of our Common Stock and sole dispositive power over 1,392,894 shares of our Common Stock. The business address of Blackrock, Inc. is 50 Hudson Yards, New York, New York 10001.

(4) Mr. Neville was appointed our Chief Executive Officer effective November 13, 2023.

(5) Includes (i) 65,878 shares of Common Stock and (ii) 84,160 shares of Common Stock which Mrs. Tannenbaum has the right to acquire within 60 days of March 26, 2024 pursuant to outstanding and vested stock options.

(6) Includes (i) 22,616 shares of Common Stock and (ii) 8,166 shares of Common Stock which Mr. Hetzel has the right to acquire within 60 days of March 26, 2024 pursuant to outstanding and vested stock options.

(7) Includes (i) 13,253 shares of Common Stock and (ii) 6,400 shares of Common Stock which Ms. Bond has the right to acquire within 60 days of March 26, 2024 pursuant to outstanding and vested stock options.

(8) Mr. Fagan was appointed our Board in June 2023. Includes (i) 2,441 shares of Common Stock and (ii) 26,520 shares of Common Stock held by Civic Reserve LLC, which is wholly owned by Mr. Fagan and his spouse.

(9) Includes (i) 8,930 shares of Common Stock and (ii) 6,400 shares of Common Stock which Mr. Frank has the right to acquire within 60 days of March 26, 2024 pursuant to outstanding and vested stock options.

(10) Includes (i) 17,273 shares of Common Stock and (ii) 6,400 shares of Common Stock which Mr. Harrison has the right to acquire within 60 days of March 26, 2024 pursuant to outstanding and vested stock options.

(11) Includes (i) 2,245 shares of Common Stock and (ii) 6,400 shares of Common Stock which Mr. Levy has the right to acquire within 60 days of March 26, 2024 pursuant to outstanding and vested stock options.

(12) Includes (i) 2,245 shares of Common Stock shares of Common Stock and (ii) 6,400 shares of Common Stock which Ms. Sudnow has the right to acquire within 60 days of March 26, 2024 pursuant to outstanding and vested stock options.

(13) Includes (i) 3,906,039 shares of Common Stock and (ii) up to 2,032,218 shares of Common Stock which our current executive officers and directors will have the right to acquire within 60 days of March 26, 2024 pursuant to outstanding and vested stock options.

| AFC GAMMA, INC. | |

| REPORT OF THE AUDIT AND VALUATION COMMITTEE |

The Audit and Valuation Committee assists the Board in its oversight of the Company’s financial statements and reporting process and audit process. The Audit and Valuation Committee operates under a written charter adopted by the Board, which describes this and the other responsibilities of the Audit and Valuation Committee. Management has the primary responsibility for the financial statements and the reporting process. Our independent registered public accounting firm is responsible for performing an independent audit of our financial statements in accordance with the auditing standards of the Public Company Accounting Oversight Board (“PCAOB”) and to issue a report thereon.

The Audit and Valuation Committee has reviewed and discussed the Company’s audited financial statements with management, which has primary responsibility for the financial statements. CohnReznick LLP, the Company’s independent registered public accounting firm for fiscal 2020,throughout 2022, is responsible for expressing an opinion on the conformity of the Company’s audited financial statements with generally accepted accounting principles. The Audit and Valuation Committee has discussed with CohnReznick LLP the matters required to be discussed by the applicable requirements of the PCAOB and SEC. The Audit and Valuation Committee has received and reviewed the written disclosures and the letter from CohnReznick LLP required by applicable requirements of the PCAOB regarding CohnReznick LLP’s communications with the Audit and Valuation Committee concerning independence, and has discussed with CohnReznick LLP its independence.

Based on the review and discussions referred to above, the Audit and Valuation Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Registration Statement on Form S-11 filed with the Securities and Exchange Commission (the “SEC”) on March 16, 2021 in connection with the Company’s initial public offering. The Company did not file an Annual Report on Form 10-K for the year ended December 31, 20202023 for filing with the SEC. The Audit and Valuation Committee also recommendsappointed CohnReznick LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 20212024 and is seeking ratification of such selectionappointment by the Company’s stockholdersshareholders at the Annual Meeting.

| AUDIT COMMITTEE | |

| Alexander Frank | |

| Thomas Harrison | |

| Robert Levy |

August 11, 2021April 5, 2024

The foregoing report of the Audit and Valuation Committee does not constitute soliciting material and shall not be deemed filed, incorporated by reference into or a part of any other filing by the Company (including any future filings) under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except to the extent the Company specifically incorporates such report by reference therein.

| 28 | 2024 PROXY STATEMENT | AFC GAMMA, INC. |

| PROPOSAL 2 |

|

The Audit and Valuation Committee of our Board of Directors has appointed CohnReznick LLP to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2021.2024. We are not required to submit the appointment of CohnReznick LLP for stockholdershareholder approval, but our Board of Directors has elected to seek ratification of the appointment of our independent registered public accounting firm by our stockholdersshareholders at the Annual Meeting.Meeting as a matter of good corporate governance. If our stockholdersshareholders do not ratify the appointment of CohnReznick LLP, the Audit and Valuation Committee will reconsider its appointment of CohnReznick LLP and will either continue to retain this firm or appoint a new independent registered public accounting firm. Even if the appointment is ratified, the Audit and Valuation Committee, in its discretion, may appoint a different independent registered public accounting firm at any time during the year if the Audit and Valuation Committee determines that such a change would be in our best interests and the best interests of our stockholders.shareholders.

We expect one or more representatives of CohnReznick LLP to participate inbe present at the Annual Meeting and they will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

The aggregate fees billed to us fromfor the period July 31, 2020 (the date of commencement of operations) throughyears ended December 31, 20202022 and 2023 by our independent registered public accounting firm, CohnReznick LLP, are set forth below:

| 2020 | 2022 | 2023 | ||||||||||

| Audit Fees(1) | $ | 66,300 | ||||||||||

| Audit-Related Fees(2) | $ | 10,000 | ||||||||||

| Audit Fees(1) | $ | 374,501 | $ | 319,300 | ||||||||

| Audit-Related Fees(2) | - | - | ||||||||||

| Tax Fees | $ | 0 | 54,180 | 68,800 | ||||||||

| All Other Fees | $ | 0 | - | - | ||||||||

| Total Fees | $ | 76,300 | $ | 428,681 | $ | 388,100 | ||||||

(1) Audit Fees represents the aggregate fees billed to us by CohnReznick LLP for professional services rendered for the audits of our financial statements for the year and period ended December 31, 2023 and 2022, respectively, and for procedures performed on our quarterly reports on Form 10-Q. During the year and period ended December 31, 2023 and 2022, respectively, Audit Fees also include services in preparation of consents and comfort letters that our auditor provided in connection with our equity and debt offerings.

(2) Audit-Related Fees represent fees billed for services rendered during the fiscal year for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and are not reported under “Audit Fees.” During the year and period ended December 31, 2023 and 2022, respectively, we did not incur any such Audit-Related Fees.

| AFC GAMMA, INC. | | 29 |

PROPOSAL 2 —- RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Audit and Valuation Committee Pre-Approval Policies and Procedures

The Audit and Valuation Committee is required to pre-approve the audit and non-audit services performed by our independent registered public accounting firm in order to assure that the provision of such services does not impair the auditor’s independence.

All services performed and related fees billed by CohnReznick LLP during fiscal 20202023 and 2022 were pre-approved by the Audit and Valuation Committee pursuant to regulations of the SEC.

|

| 30 | 2024 PROXY STATEMENT | AFC GAMMA, INC. |

| TRANSACTIONS WITH RELATED PERSONS |

Policies and Procedures Regarding Related Party TransactionTransactions

Our Board has adopted written related person transaction policies and procedures. The purpose of this policy is to describe the procedures used to identify, review, approve, disapprove, ratify and disclose, if necessary, any transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) with related persons. Under this policy, the Audit and Valuation Committee will beis responsible for reviewing, approving or ratifying each related person transaction or proposed transaction, subject to certain exceptions. In determining whether to approve or ratify a related person transaction, the Audit and Valuation Committee or its chairperson, as applicable, will consider all relevant facts and circumstances of the related person transaction available to it and will approve only those related person transactions that are, under all of the circumstances, fair as to us, as the Audit and Valuation Committee or its chairperson, as applicable, determines in good faith.

This policy may not be successful in eliminating the influence of conflicts of interest or related person transactions. If they are not successful, decisions could be made that might fail to reflect fully the interests of all stockholders.

Certain RelationsRelationships and Related Party Transactions

Since our formation, in July 2020, we have engaged in the following transactions with our directors, executive officers or holders of more than 5% of our outstanding share capital and their affiliates, which we refer to as our related parties.

The Initial Portfolio Transaction

We acquired our initial portfolio of loans at fair value of approximately $46,802,840 and cash from AFC Warehouse, LLC and LMT Investments, LLC, each of which is wholly-owned by our Sponsor, in exchange for the issuance of 3,342,500 shares of our common stock (on a post-split basis) on July 31, 2020 (date of commencement of operations) (the “Initial Portfolio Transaction”). The initial portfolio consisted of loans to Public Company A, Public Company B and Private Company A, as well as two loans to other entities that are no longer borrowers that we subsequently sold after our acquisition.

Revolving Credit Agreement

On August 18, 2020, we entered into the Revolving Credit Agreement pursuant to which Leonard M. Tannenbaum (our “Sponsor”) and Jonathan Kalikow, our Head of Real Estate and one of our directors, both through AFC Finance, LLC, an entity wholly-owned by our Sponsor and Jonathan Kalikow, provided our secured revolving credit facility (“Revolving Credit Facility”). In May 2021, the Revolving Credit Facility was amended to, among other things, remove Gamma Lending Holdco LLC as a Lender. The Revolving Credit Facility now provides revolving loan commitments of up to $50.0 million and bears interest at a fixed rate of 6.0% per annum, payable in cash in arrears. As of June 15, 2021, we had not yet drawn on, or paid any fees under, our Revolving Credit Facility since entering into the Revolving Credit Agreement on August 18, 2020. Future proceeds under the Revolving Credit Facility are available to fund loans and bridge capital contributions and for general corporate purposes. We did not incur any fees or costs related to the origination of the Revolving Credit Facility and we are not required to pay any commitment fees under the Revolving Credit Agreement. Our obligations under the Revolving Credit Agreement and the other loan documents delivered in connection therewith are secured by a first priority security interest in substantially all of our existing and future assets. The maturity date of the Revolving Credit Facility is the earlier of (i) December 31, 2021 and (ii) the closing date of any Refinancing Credit Facility.

Management Agreement